Why I built a 4 year CD ladder

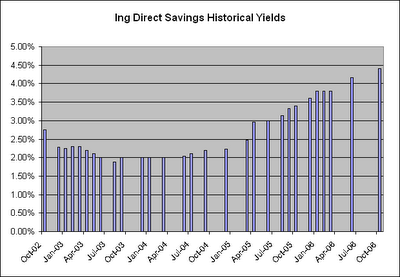

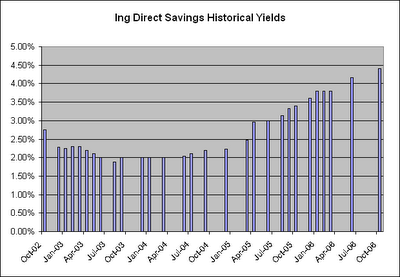

The reason is pretty clear when you look at Ing Direct Orange Savings Account Yields for the past four years:

Although 5% yields have made cash a nice place to be in 2006, the above data shows this hasn't been the case since the FOMC started cutting the Federal Funds Rate in 2001.

We are now seeing hints of another FOMC rate cutting cycle, which has caused Treasury and CD rates to drop since August. Seeing that, I tried to learn from past experience and decided to lock in existing rates for some of my cash holdings by building a 4 year CD ladder.

Over the last few weeks, I have bought 1,3, and 4 year CDs with a 6% yield in equal dollar amounts. Today, I completed my 4 year ladder by opening an E-LOAN 5.75% APY 2 year CD.

The result is a 4 year CD ladder with equal amounts invested as follows:

Knowing what I know now, I wish that I had the foresight in late 2000 to lock up some cash in CDs yielding 6% when the economy was showing signs of slowing down. If savings account yields fall below 2% again (like Ing did in August 2003), I will feel like I made a wise decision. And if yields happen to rise, then I can always reinvest my 6% CDs at the higher rates when they mature over the next few years.

Although 5% yields have made cash a nice place to be in 2006, the above data shows this hasn't been the case since the FOMC started cutting the Federal Funds Rate in 2001.

We are now seeing hints of another FOMC rate cutting cycle, which has caused Treasury and CD rates to drop since August. Seeing that, I tried to learn from past experience and decided to lock in existing rates for some of my cash holdings by building a 4 year CD ladder.

Over the last few weeks, I have bought 1,3, and 4 year CDs with a 6% yield in equal dollar amounts. Today, I completed my 4 year ladder by opening an E-LOAN 5.75% APY 2 year CD.

The result is a 4 year CD ladder with equal amounts invested as follows:

- World Savings: 15 month CD @ 6.01% APY

- E-LOAN: 2 year CD @ 5.75% APY

- Penfed: 3 year CD @ 6.00% APY

- Penfed: 4 year CD @ 6.00% APY

Knowing what I know now, I wish that I had the foresight in late 2000 to lock up some cash in CDs yielding 6% when the economy was showing signs of slowing down. If savings account yields fall below 2% again (like Ing did in August 2003), I will feel like I made a wise decision. And if yields happen to rise, then I can always reinvest my 6% CDs at the higher rates when they mature over the next few years.

2 Comments:

It's always good to lock in the excess cash at higher interest rates, so your ladder is certainly going to give you better returns.

On the rate side, I don't think it is anything like 2000 yet and the way it is going it is not going to be 2001 anytime soon. So hopefully we won't see those near zero interest rates. :)

By GolbGuru, at 10/5/06, 1:09 AM

GolbGuru, at 10/5/06, 1:09 AM

I certainly didn't complain about low interest rates when I refinanced my mortgage three years ago. :)

Although the recent housing bubble showed that we didn't learn our lesson from the stock bubble in 2000, I agree that we are currently in better shape than 2000-2001.

I just think it looks like high yield money market yields will be lower than they are now one year from now.

By Frugal Frugalson, at 10/5/06, 9:55 AM

Frugal Frugalson, at 10/5/06, 9:55 AM

Post a Comment

<< Home